Why is my loan getting rejected in South Africa?

Summary of this blog post:

-

Three main reasons a bank may reject your loan application, but a debt review flag is the main reason.

-

Affordability is based on your income and current expenses (financial obligations).

-

You can improve your affordability and qualify for a loan by increasing your income, cutting down your expenses, paying off your current debt, undergoing debt counselling, and getting a full financial health report.

-

Give yourself at least six months before the next time you apply for a loan.

There are a number of reasons your loan application can be rejected. A few of these reasons include:

- Poor affordability (associated with your income and how much debt you have)

- Risk profile (whether or not you have a bad or no credit history)

- If you have a debt counselling (debt review) flag on your credit report

Did you know: your loan application is immediately rejected if you have a debt review flag (warning) on your credit report.

What is a debt review flag?

When you register for the debt counselling (debt review) process in South Africa, your credit report is updated with a debt review flag/ warning. Once you have successfully completed the debt review process, this flag should be removed from your profile and because of this, have no negative impact when it comes to you applying for credit.

The debt review flag is put on your credit report to let credit lenders know that they should not be giving you access to credit. The reason for this is because it would be seen as reckless lending according to the National Credit Act (NCA).

How do I know if I have a debt review flag on my credit report?

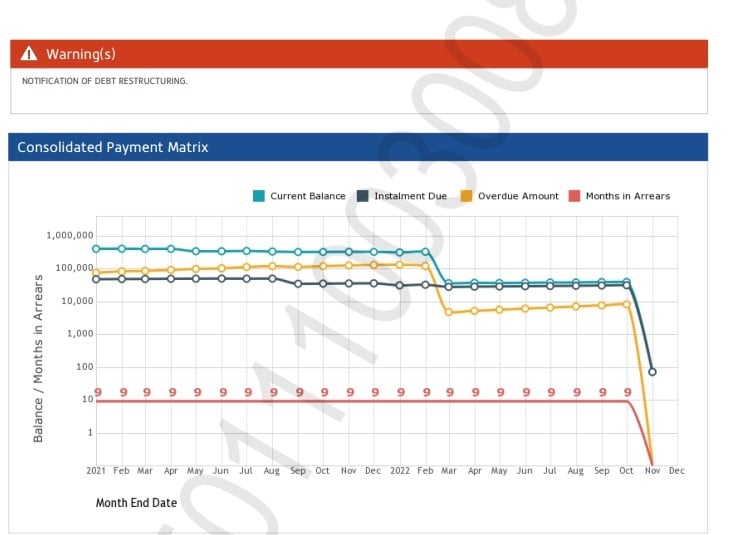

View a free copy of your credit report and see if you have a warning/ flag like the one in the image below.

If you do have this debt review flag, and you think this may be an error on your credit report, because you have:

-

Completed the debt review process.

-

Paid up all your debts in full.

You can get cleared and have this flag removed from your profile so that you can start applying for credit again.

Start your easy online application. We’d be happy to help you get cleared.

Read more: Removal from debt review: everything you need to know

What does declined due to affordability mean?

When you apply for a loan, a credit lender like a bank, will use different methods to calculate whether you can afford to make the repayments on your loan. If they reject your loan application due to affordability it means they do not think you would be able to make the repayments based on your current income and current financial obligations ( existing debt repayments).

What can you do if your loan has been declined because of affordability?

1. Do not apply for another loan for the next 6 months.

-

If you’ve been rejected for a loan, your next response may be to apply for another loan with a different bank or credit lender. This will not be in your best interest. The reason is that several rejected loan applications will negatively affect your credit score. This means that not only will you be rejected because of your affordability, you may be rejected because of a poor credit score too.

2. Investigate your financial health with Meerkat.

-

By registering for an account on Meerkat, we’ll give you information about everything a lender will consider before approving your loan:

-

Your affordability level

-

Your credit score

-

Your debt capacity (your ability to meet your repayments of your debt)

-

Register for this free financial assessment.

3. If you are able to, try and increase your income.

-

Ask for a pay raise or get a higher paying job. Yes, both of these options are not easy, but this is one route to improve your affordability levels.

By increasing your income, you will have more money after paying your current financial obligations. This will mean that-depending on the loan amount you have requested-you will more likely be able to afford to make the repayments on that loan agreement.

4. Budget. Budget. Budget.

-

By working out a reasonable budget, you may be able to cut down on some of your expenses. Because of this, you will be better able to afford to repay a loan.

Read more: How to start a budget in 6 simple steps

5. Pay off your current debt

-

If you are unable to make all your debt repayments, and if you have missed a few months paying some of your debt, you could be over-indebted. If you find yourself in this position, there is hope, and you can gain control of your finances again.

6. After six months, request a loan for a smaller amount, and during those six months, save up for the rest of the loan amount.

At Meerkat, we offer an easy savings solution:

- No account fees.

- No red-tape to withdraw your own funds.

- An opportunity to start saving towards your goals for only R25 per month.

The truth about poor affordability

The truth is, if you are looking to get a loan, and you are unable to because of your affordability, you are probably over-indebted.

Over-indebted can be another way of describing poor affordability or a lack of affordability. While this may be discouraging, there is a way to pay off your debt and improve your affordability.

With debt counselling you can improve your affordability

When you register for debt counselling, a Debt Counsellor will first determine whether you are over-indebted. Part of the debt counselling process involves reducing the interest rate on your current credit agreements. This means you will end up paying less for your debt in the long run.

Our expert Debt Counsellors at Meerkat will also-based on your current expenses and lifestyle- put together a reasonable living budget so that you can pay for your expenses and live your life.

Why Meerkat?

Meerkat is registered with the NCR (National Credit Regulator – NCRDC2613). We understand that life happens, and you can start to fall behind on your debt repayments. We can help you regain financial control and walk the journey with you to becoming debt-free. As a team, we’re looking out for you.

We also offer competitive credit life cover to protect you and your family if you die, are retrenched, become disabled or suffer a severe illness.

Do you know how much you are paying on your current loans for cover? We may be able to replace your existing cover where it makes sense to do so.

We will also kickstart an emergency savings fund as part of your debt management plan. This ensures you have funds available for when life happens. Don't delay, get started today!

Leave your details and we’ll give you a call back to discuss how we can help.

Professional service and complete confidentiality are guaranteed. Join the thousands of Meerkat clients that are on their way to financial freedom.

.png?width=640&height=360&name=Untitled%20design%20(3).png)