Debt counselling in South Africa

What is Debt Counselling?

Debt counselling, also known as debt review or credit counselling, is a legal debt relief process introduced in South Africa under The National Credit Act (NCA). It provides a structured way to manage debt for those who are struggling to meet their financial obligations.

Think of it as a form of debt consolidation but without having to take out a loan.

What is a Debt Counsellor?

Debt Counsellor meaning: A Debt Counsellor in South Africa must be registered with the National Credit Regulator (NCR). You can find a list of registered Debt Counsellors here including the national debt counsellors contact details.

Is debt counselling right for you?

Debt counselling is ideal if:

- Your income isn’t sufficient to cover your monthly debt and living expenses.

- You’re constantly stressed about debt and basic necessities.

- You’re borrowing money to pay off existing debts or missing repayments.

How does debt counselling work in South Africa?

- Apply for Debt Counselling: Start by contacting a registered Debt Counsellor or debt counselling company. Ensure they are listed on the National Credit Regulator’s (NCR) website. All of the Debt Counsellors at Meerkat are registered with the NCR.

Moku tip: Before agreeing to sign up with any debt review company, check that they are registered on the National Credit Regulator’s website.

Meerkat’s CEO and Founder, David O’Brien is a registered Debt Counsellor with the NCR. You can confirm this here.

2.Financial Assessment: Complete a Form 16 and undergo a financial assessment to determine your level of over-indebtedness based on your income and expenses.

3. Repayment Plan: If deemed over-indebted, your Debt Counsellor will create a debt management plan that balances debt repayment with your living expenses. This plan will be formalized in court to protect your assets and prevent legal action. It also includes your repayment terms.

At this point, your Debt Counsellor negotiates with creditors to reduce the interest rates on your loans. This could end up saving you money in the long run.

4, Plan Implementation: Once approved, your repayment plan will be communicated to credit bureaus, and your credit profile will be flagged as under debt review. Meerkat offers personalized support throughout this process.

5. Debt Repayment: Make a single, reduced monthly payment, distributed to creditors by a Payment Distribution Agency (PDA). Meerkat partners with Hyphen, a leading PDA, to ensure secure and efficient management of your payments.

6. Completion: After paying off all your debts, you’ll receive a Debt Review Clearance Certificate, and your credit profile will be updated to reflect successful completion.

Impact on Your Credit Score

Debt counselling doesn’t harm your credit score. In fact, it can help rehabilitate it by demonstrating your commitment to timely repayments.

Checking Your Debt Review Status

You can verify if you’re under debt review by checking your credit report for a debt review flag. Get your free credit report here!

Example of Debt Counselling Success

Consider the Dlomo family, who reduced their total debt from R591,157 with a monthly installment of R41,000 to R18,000. Negotiations led to a reduction in their average interest rate from 36% to 8%, significantly lowering their total debt.

What are the disadvantages of debt counselling?

A common disadvantage that frightens many people is that undergoing debt counselling means that you won’t be able to apply for more loans while you’re undergoing the process.

This means that if you apply for a loan while under debt review, a credit lender will check your credit report and you will immediately be denied because of the debt review flag on your credit report.

The reason for this is simple: you cannot get out of debt by creating more debt. While a loan will provide short-term relief because you can pay for whatever it is you really need to pay for, it just adds to your debt burden.

The reality is, if you cannot afford to pay all your debts and if you cannot afford to buy essential items like electricity and groceries, more debt (a loan) will only drive you into further debt.

Not having access to credit for a short period is scary, but permanently being stuck in a crippling debt cycle is even scarier.

Can I buy a house after debt counselling?

Once you have successfully completed the debt counselling process, you will be able to buy a house after.

To buy a house, you will have to slowly take out a small amount of credit and show that you can consistently pay for this account. For a home, a good idea is to show that, for a year, you can consistently make these payments.

Who pays the Debt Counsellor?

The consumer (you) pay the debt counselling fees. What’s really beneficial for you is that these fees are all regulated. This means that a registered Debt Counsellor or debt counselling company cannot charge you more than the prescribed fees set out by the National Credit Regulator (NCR).

Debt counselling fees

Your monthly repayment for the first two months is usually the equivalent to your debt counselling fees. This monthly repayment will be based on your current financial situation, including your total debt amount and income, as well as the time it will take to complete the entire process.

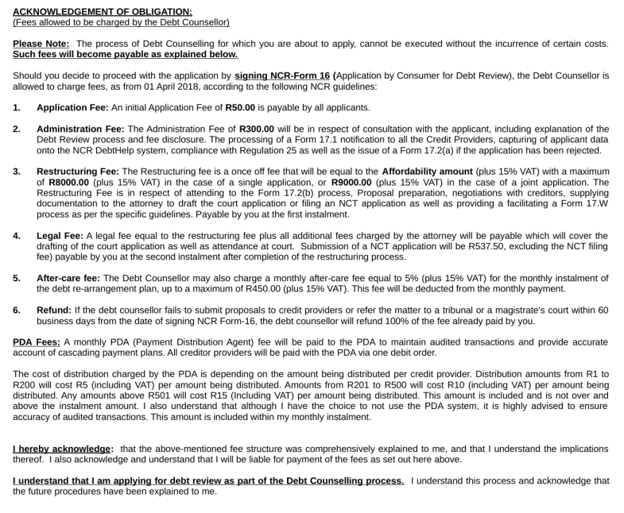

See the image below for an outline of fees, and what you can expect before signing up for debt counselling at Meerkat. A reminder that these fees are aligned with the guidelines put forward by The National Credit Regulator.

How do I remove my name from debt counselling?

To leave the debt review process, you need a debt review clearance certificate. The only individual who can issue a debt review clearance certificate, is a registered Debt Counsellor.

Meerkat can assist you with the administration of this debt review clearance certificate. You must, however, have paid up all your debts, or the debts that you haven’t paid, must have prescribed. If you’ve paid up all your debts, and the only debt you haven’t paid is your home loan, you also qualify for a clearance certificate.

Can I cancel debt review early?

No, you can’t. Since 2022, you cannot leave the debt counselling process early. This is even prior to being declared over-indebted. Practically this means that once you have applied for debt counselling, you cannot leave the process until you have paid all your debts, other than your home loan, in full.

How long does debt review stay on your name?

This depends on how much debt you have and how much you are able to pay towards this debt each month.

The key role-players in debt counselling

- Debt counselling company: For example Meerkat.

- The specific Debt Counsellor who is handling your application.

- National Credit Regulator: This body regulates the South African credit industry. They are there to protect consumers. All debt counselling practices are regulated by the NCR.

- Payment Distribution Agency (PDA): These are the payment distributors who handle your money. Your money does not go directly to a Debt Counsellor. Instead, it is paid to a PDA, who then distributes your money to your creditors.

Moku tip: Your debt counselling company should be partnered with a reputable PDA for this process to run smoothly. You should also never be paying money directly to your Debt Counsellor.