Get the debt review flag removed in 2024

If you want the debt review flag removed from your credit report, you must have paid up your debt. The only debt that can be outstanding is your home loan. The only other way it can be removed is if your debt has prescribed (been written off) after the prescription period has ended.

The duration of a prescription period may vary depending on the type of loan, but it is typically around three years. Once this period has passed and your debt has prescribed, creditors are no longer able to demand payment from you.

Read: How to remove prescribed debt from your credit report

How much does it cost to remove the debt review status in South Africa?

Your debt review costs will depend on whether or not you have the paid-up letters from your creditors. If you do, you can get the debt review status removed for R1150 (including VAT). If you don't have the paid-up letters, don't worry, we can still help you. There will just be extra costs involved to obtain those paid-up letters too.

Who can terminate the debt review process?

The only person who can terminate the debt review process is a registered Debt Counsellor. And the Debt Counsellor can only do this, if you have paid up all your debts, and as such, are no longer over-indebted.

How can I remove my debt review status for free?

You can't remove the debt review flag for free. There will always be fees involved. This will either be for lawyers fees or for the services of a Debt Counsellor. You should be very wary of anyone or any company claiming they can do it for free.

It's important to understand that removing the debt review flag from your credit report is not a free process. There are always fees involved, whether it be for lawyers' fees or for the services of a Debt Counsellor. Be cautious of anyone or any company claiming that they can remove the debt review flag for free, as this is highly unlikely.

While it may be tempting to try and find a free solution, it's important to consider the potential risks and consequences. One of these risks include becoming even further indebted.

By working with a reputable Debt Counsellor, you can ensure that your interests are protected and that the debt review flag is legally removed.

You should also be wary lawyers promising debt review removal services. These services may can end up costing quite a bit of money. Any debt review removal service that charges you in excess of R5000 is exploitative.

How do I get a court order to remove debt review?

It's important to understand that once a judgment has been granted, it cannot be reversed. However, if no judgment has been granted, there is a possibility of obtaining a court order that declares you are no longer over-indebted.

To achieve this, you will need to provide evidence of significant changes in your financial circumstances, such as securing a new job or other substantial improvements.

Alternatively, if you have fully paid off all your debts, a quicker option would be to have the debt review flag removed by our dedicated team at Meerkat. We have already helped thousands of South Africans successfully clear their debt review status.

How long does it take to be cleared from debt review?

By choosing Meerkat, you can conveniently eliminate the debt review flag from your credit profile in a mere 10 days. The entire process can be effortlessly completed online, saving you both valuable time and money. Once you have successfully completed the debt review process and settled all your outstanding debts, Meerkat will swiftly remove the debt review flag from your credit report, allowing you to regain financial freedom in no time at all.

Debt review removal process online explained

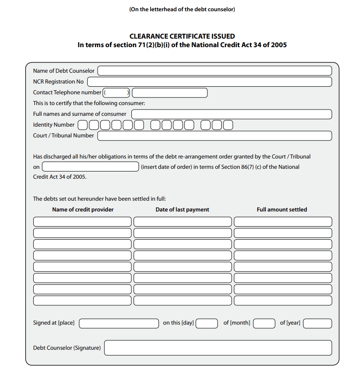

*R1000 application fee in the image above is excluding VAT.

*R1000 application fee in the image above is excluding VAT.

To begin the process, simply complete our user-friendly online application form. It's quick and hassle-free.

Once you've done that, you can easily upload your paid-up letters from your creditors. Don't worry if you don't have these letters yet, we can assist you in obtaining them for an additional fee.

After that, we'll retrieve your credit record and update your creditors and credit bureaus accordingly. This ensures that your status and credit report are accurately reflected.

Finally, we'll issue you with a debt review clearance certificate, granting you the freedom to start applying for credit once again.

Debt review removal reviews from clients at Meerkat

Quick Removal from Debt Review

"Mrs Hendricks was very help in removing me from Debt Review. Meerkat is quick and efficient in delivery. I highly recommend their services to anybody who is need of their service offerings."

Can you leave the debt review process early?

Starting from March 2022, the National Credit Regulator (NCR) confirmed that individuals are no longer allowed to opt out of the debt review procedure, even before being officially declared as over-indebted. Essentially, this implies that once you initiate the debt review (debt counselling) application, you are obligated to continue with the process. Because of this, it is crucial to carefully consider this decision before proceeding.

Benefits of a clearance certificate from Meerkat:

1. Legally exit the debt review process: Obtaining a clearance certificate from Meerkat allows you to officially and legally exit the debt review process. This means that you have successfully resolved your financial obligations and can move forward with a clean slate.

2. Save money and time by completing the entire process online: Meerkat offers the convenience of completing the debt review clearance process online. This saves you valuable time and eliminates the need for in-person appointments or visits to financial institutions. Additionally, by choosing Meerkat, you can also save money on legal fees and other costs associated with the debt review process.

3. Start applying for credit again: Once you have obtained a clearance certificate from Meerkat and the debt review flag has been removed from your credit report, you regain the ability to apply for credit. This opens up opportunities for obtaining loans, mortgages, and other financial products that may have previously been inaccessible due to the debt review status.

4. Get cleared and remove the debt review flag from your credit report: The primary benefit of obtaining a clearance certificate from Meerkat is that it effectively removes the debt review flag from your credit report. This enhances your creditworthiness and improves your chances of being approved for future credit applications. With the debt review flag removed, lenders and credit bureaus will view you as a responsible borrower, increasing your financial opportunities.

In conclusion, obtaining a clearance certificate from Meerkat offers numerous benefits. It allows you to legally exit the debt review process, saves you time and money by providing an online solution, enables you to start applying for credit again, and ultimately removes the debt review flag from your credit report. With Meerkat's assistance, you can achieve financial freedom and regain control of your credit score again.

Who is Meerkat?

Meerkat is a financial wellness company that wants to help South African consumers do MORE with their money. We can help with debt repayment negotiations, provide affordable insurance and help you kickstart an emergency fund

Fill in the contact form on our website to receive a free callback from the Meerkat team today.